The local real estate market set new home price records in many parts of the region in February. Prices here have grown faster than anywhere else in the country for the last 16 months in a row. Demand remains high and inventory very low. Brokers are hoping the normal seasonal increase in listings this spring will help give buyers some relief.

Eastside

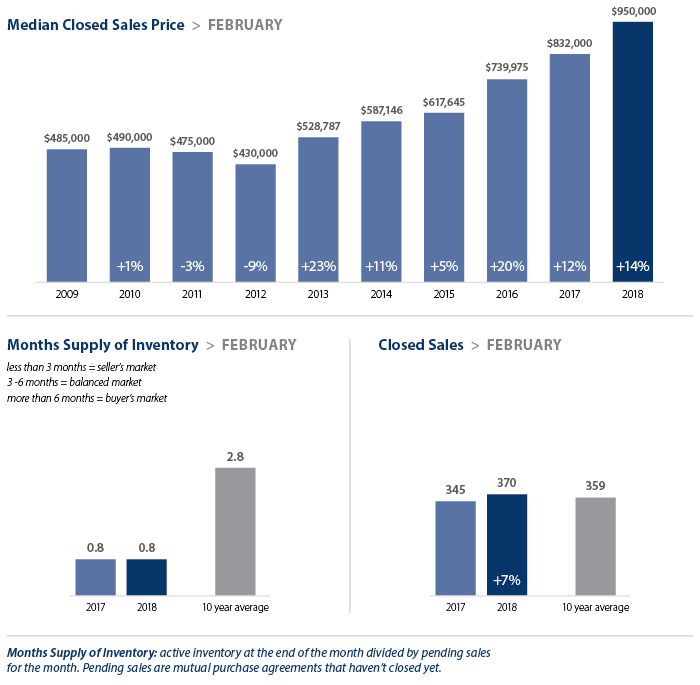

With home prices soaring on the Eastside, it’s not a matter of whether the median price will exceed a million dollar, but when. February brought the market very close to that milestone. The median price of a single-family home increased 14 percent to a record $950,000 on the Eastside, surpassing the previous peak recorded in December.

King County

The red-hot job market in King County continues to outpace nearly every area in the nation. Well-paid workers looking to buy close to city centers have fueled a growing competition for a shrinking number of homes. That demand boosted the median price of a single-family home up 16 percent over a year ago to $649,950.

Seattle

The median price of a single-family home in Seattle hit a new high of $777,000 in February, $20,000 more than the previous record set in January and up 14 percent from the same time last year. Despite the sharp increase in prices, multiple offers have become the norm for most properties. It remains to be seen if recent interest rate hikes will have a moderating effect on home values.

Snohomish County

After several months of moderating growth, Snohomish County set a new record for home prices in February. The median price of a single-family homes jumped 18 percent to an all-time high of $485,000. Inventory is down from a year ago, with less than a month’s supply of homes available for sale.

If you are considering buying a home in today’s market, here are three things to consider:

- Make sure you can afford the payments.

- Choose a location that will appeal to you long-term.

- Be committed to living there for a minimum of five to seven years.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link